Swap tokens: Understanding slippage

Slippage

When you swap tokens, there is almost always slippage. Slippage is the monetary difference between the expected price of a trade and the executed price of a trade.

The amount of slippage is dependent on available liquidity relative to order size. For small orders of high-demand assets, slippage can be relatively negligible; however, a large order of an asset with less availability brings with it a higher likelihood of slippage.

Slippage, therefore, holds an inverse correlation to liquidity: higher market liquidity reduces slippage, while low liquidity in the market will increase the percentage of slippage.

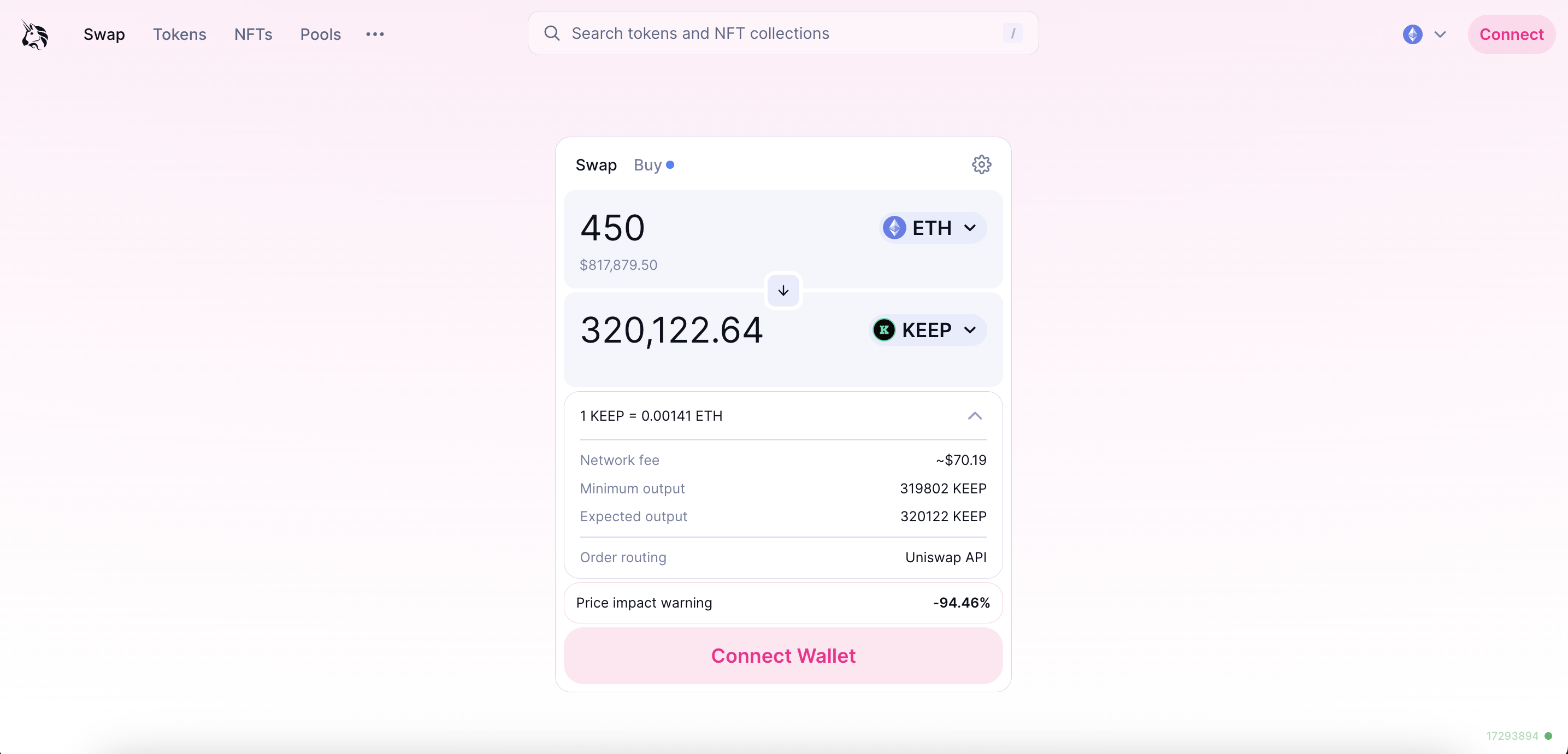

Let’s use an example to show a large amount of slippage in market rates through the largest decentralized exchange (DEX): Uniswap. For this example, we will use Uniswap’s term for the traditional understanding of slippage: price impact.

In this example, the trader is trying to trade ETH to KEEP and is quoted 450 ETH for 320,122.64 KEEP tokens. However, due to the large trade size relative to the liquidity residing in this pool, the price impact is extremely high (-94.46%). This effectively means the trade has slipped 19.17% of the asset value (i.e. the user will receive 94.46% less value than ordered) due to insufficient liquidity depth in this pool compared to the trade.

In order to avoid high amounts of slippage when you swap tokens, it is important to swap in pools that have sufficient liquidity and volume resulting in better rates for your swaps. In addition, many interfaces will allow you to set a price with a slippage tolerance to limit a trade from going through in unfavourable conditions. If the price moves suddenly in the middle of a market trade, the transaction may fail due to the slippage levels greater than what was approved.