What is THORChain Part 2

THORSwap

THORChain is a cross-chain liquidity network built as an independent blockchain protocol on Cosmos, the so-called “Internet of blockchains”.

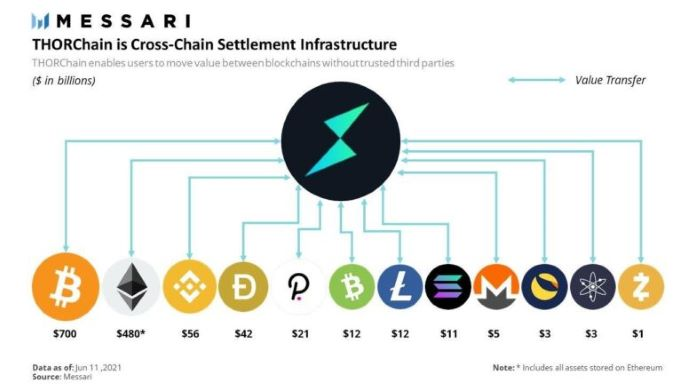

THORChain enables the trading of native crypto-assets across blockchains, such as Bitcoin for Ethereum, but in a completely decentralised and permissionless way and without relying on pegged or wrapped tokens.

This has not been possible in the past. Users who wanted to trade tokens across different blockchains have been dependent on centralised, custodial exchanges, sacrificing many of the core principles of cryptocurrencies such as decentralisation, immutability and self-custody.

The History of THORChain

The origin story of THORChain goes back to a hackathon in 2018, where the primarily anonymous team behind the project first talked about the cross-chain liquidity problem. Key concepts of the new protocol, including Continuous Liquidity Pools (CLPs) and a liquidity-sensitive slip-based fee model, have been introduced.

Source: Messari, June 2021

THORChain’s Chaosnet (also called Multichain Chaosnet; MCCN) was finally launched in April 2021 and currently supports the non-custodial trading of BTC, ETH, BNB, BCH, LTC, DOGE and many ERC20 tokens. In the meantime, it also gave birth to multiple spin-off projects like THORSwap, Thorstarter, THORWallet, DeFiSpot, Asgardex and many others.

Core Mechanics of THORChain

Thanks to THORCHain, liquidity pools replace the model used by centralised exchanges of custodied assets and order books. Now, anyone can be an LP by providing assets to a liquidity pool and earning rewards, not unlike popular decentralised exchanges using an AMM model (automated market maker) like Uniswap or SushiSwap.

The main differentiator for THORChain is that its liquidity pools can hold native crypto assets from different blockchains (such as ETH and BTC) and can therefore take those assets from one blockchain and send them out to another.

This behaviour is mainly enabled by THORNodes, who safeguard all assets in liquidity wallets and facilitate all ongoing trades. A THORNode is run by a node operator who simultaneously runs nodes on multiple blockchains like Bitcoin, Ethereum, or Litecoin. A node operator needs to bond a significant amount of capital himself which can be slashed in case of harmful behaviour to the protocol. On the other side, node operators – who make it in the currently active validating subset – also receive a share of the network income.

Incentives for node operators and liquidity providers are determined by an “incentive pendulum”, which ensures a healthy balance between bonded and pooled funds in the network. If the network is under-bonded, node operators are incentivised to increase their bonds; if it’s over-bonded, liquidity providers are incentivised to pool more assets.

The RUNE Token and Why It Is Special

The RUNE token is Thorchain’s native asset, used for governance, staking, bonding, rewards, and trading – it’s the oil that keeps the machine running. RUNE always takes one of two assets in every liquidity pool and therefore acts as a bridge for trading between two assets, such as BTC and ETH.

THORChain’s tokenomics are engineered so that the RUNE price increases deterministically, which is a unique mechanic. The network requires RUNE to be bonded 2:1 by node operators and paired 1:1 with pooled assets by liquidity providers, ensuring that the market cap of RUNE is at least 3x the total value locked of non-RUNE assets.

The Benefits of THORChain at a Glance

Let us summarise the most important benefits of THORChain:

– Distribution of risk across an extensive network of THORNodes

– Permissionless access to global liquidity

– Manipulation-resistant price feeds (no dependency on oracles)

– Shared incentives for all participants (node operators and liquidity providers)

– Non-custodial staking of assets

– On-chain swaps with no pegged tokens

A Glimpse Into the Future

Cross-chain swaps are just the beginning for THORChain. There are many possible use cases on top of THORChain’s cross-chain liquidity network. Soon, the protocol will introduce synthetic assets, borrowing and lending, leveraged trading and other functionalities, summarised under the keyword “ThorFi”.

The next step for the network is to upgrade the current Chaosnet to Multi-Chain Mainnet and integrate additional blockchains.