$XDEFI Tokenomics

$XDEFI is an ERC-20 token designed by Delphi Digital. Its main purpose is to create a long-term incentive for ecosystem participants to build into a community and maintain a suite of products around the wallet.

Read on to learn more about the $XDEFI tokenomics.

$XDEFI Tokenomics

The $XDEFI token follows a veModel, which is a design originally pioneered by Curve. It allows token holders to stake and earn a share of XDEFI swap and bridge fees.

XDEFI generates revenue from swaps (both in-wallet and in our Web App), as well as single-sided staking (Zaps), which is a feature of our Web App.

- 75% of the net revenue generated from all swaps, bridging and staking are used to buy $XDEFI on the open market. These purchased tokens are rewarded to token holders who stake $XDEFI.

- Swaps via Circle CCTP (USDC Bridging) are free. Users only pay gas fees.

- All other XDEFI swap and bridge fees are 0.3% (65% cheaper than MetaMask!)

This model creates a virtuous cycle for the $XDEFI token holders:

- More XDEFI Wallet and Web App users means

- Larger swap & bridge volume (and more fees earned), which means

- Larger $XDEFI buybacks and greater rewards for $XDEFI stakers

Note: in the near-term, $XDEFI staking rewards will continue to be supplemented with funds from the XDEFI treasury.

$XDEFI Token Utility

- Staking

As discussed above, $XDEFI holders can stake their tokens to earn a share of XDEFI swap and bridge fees.

Note: in the near-term, $XDEFI staking rewards will continue to be supplemented with funds from the XDEFI treasury. - Governance rights

Today, $XDEFI token holders and stakers can vote on XDEFI Wallet community proposals such as native chain integrations, new product features, and fee distribution. This gives holders a say in the development of the platform. - Gas abstraction (coming soon, est. Q1 2024)

XDEFI tokens can be locked up in a gas tank to cover gas costs for transaction signing within the wallet and when interacting with external dApps. This is done to provide a seamless and simplified user experience, without having to worry about storing gas tokens on each address. - Premium Features (est. 2024)

In the future, further utility for $XDEFI token holders will be launched including for example wallet skins & preferential access to certain XDEFI Campaigns.

Token Information

- Total supply: 240,000,000 $XDEFI

- Initial supply: 40,251,026 $XDEFI

- Circulating supply can be found here.

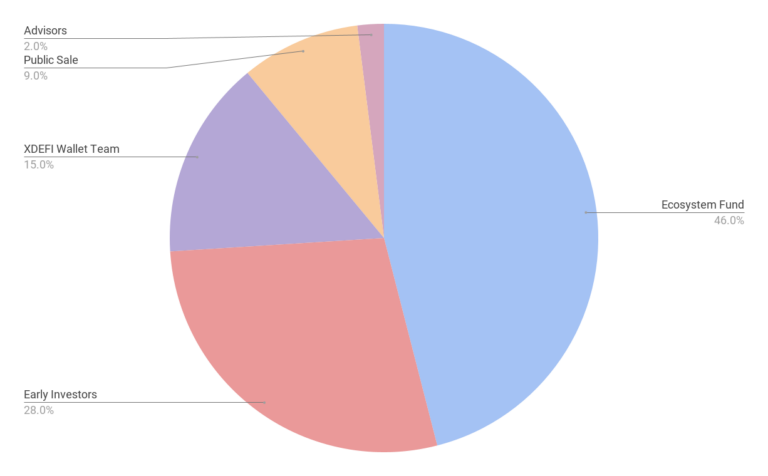

Token Distribution

- 46% to the Ecosystem Fund

The Ecosystem Fund is controlled by $XDEFI governance and the team, and can be used to supplement $XDEFI staking rewards, provide grants to developers and partners, fund certain programs such as Play to (L)earn and other programs that are designed to grow the Ecosystem. - 28% to Early Investors

These tokens go to XDEFI’s early investors who funded the initial development of XDEFI Wallet. The investments took place over two private funding rounds in 2021 and 2022, and these tokens are subject to a 3-year schedule. - 15% to the XDEFI team

These tokens go to current and future team members. Team member allocations are subject to a 4-year vesting schedule. - 9% to the Public Sale

These tokens go to investors in the XDEFI public sale which took place on 15 November 2021. All of these tokens were immediately available to Public Sale investors following the Dutch Auction. - 2% to Advisors

These tokens go to individuals that provided critical advice and support early in XDEFI’s development. All of these tokens are subject to a 3-year vesting schedule beginning in April 2022.

INVESTMENT ROUNDS

| Price per $XDEFI | Amount Raised | Date Announced | Vesting from TGE | |

| Seed | US$0.027 | c.US$1.2M | Mar. 2021 | 25% unlock at TGE and 3 years linear monthly vesting for the rest |

| Private Sale | US$0.25 | c.US$6M | Sept. 2021 | 25% unlock at TGE and 3 years linear monthly vesting for the rest |

| Public Sale¹ | US$0.65 | c.US$8.2M | Nov 2021 | Immediate |

| Public Dutch Auction² | US$1.26 | c.US$11.2M | Nov 2021 | Immediate |

¹ Whitelisted addresses only. The crowdsale was limited to the first 15,000 whitelisted XDEFI Wallet users, eligible THORChad supporters and ETH addresses with a Degen Score over 250.

² Public Dutch auction on MISO, Sushi’s launchpad.