Being a Liquidity Provider in DeFi

Liquidity providers in DeFi (Decentralised Finance) are investors that want to put their digital assets to work in order to achieve additional passive income through rewards. In this article, we explain how this works as well as the associated risks.

Since the launch of decentralised exchanges (DEXs) with pioneers like Bancor and Uniswap and the rise of Decentralised Finance (DeFi) in summer 2020, owners of crypto assets can generate additional passive income by providing funds as liquidity. However, the term impermanent loss (IL) has been widely discussed and has scared off many people from acting as liquidity providers themselves.

Some people are fearful of impermanent loss without fully understanding the concept behind it.

In this article, we want to explain the basic concept of providing liquidity and the risk of impermanent loss to you in an objective manner so that you can better understand how to provide liquidity to a decentralised exchange and what risks you are facing.

Decentralised Exchanges

Let us first explain the concept of decentralised exchanges. Most decentralised exchanges are automated market makers (AMMs). It is the most common form of a decentralised exchange and was first developed by Bancor where the asset price is not defined by an order book but instead by a mathematical formula.

The most used formula is “x * y = k”, where “x” is the amount of token 1 in the liquidity pool, “y” is the amount of token 2 and “k” is a fixed constant, meaning the pool’s total liquidity always has to remain the same leading to pools consisting of the equal ratio between two tokens (50%:50%). For users of AMMs, it is important to have as much liquidity as possible since this will lead to a lower price impact (price impact is the influence of a user’s individual trade over the market price of an underlying asset pair. It is typically directly correlated with the amount of liquidity in the respective liquidity pool).

The most prominent DEXs that use this model and therefore pose the risk of impermanent loss are Uniswap, Sushiswap, Bancor, Pancakeswap, and Thorchain. Bancor (since Version 2.1) and Thorchain (since MCCN) also offer “IL insurance” in order to mitigate the risk for their LPs.

You can read more about the detailed mathematical model and its implications here.

Liquidity Pools

Liquidity pools are at the heart of AMM-based DEXs. Any pool consists of two equivalent values of two tokens, for example, 50% DAI and 50% ETH in the ETH/DAI pool. Liquidity providers (LPs) are the ones that add their capital to those pools that traders (who want to exchange DAI and ETH) can trade against. As a reward, LPs receive trading fees (e.g. Uniswap V2 charges 0.3% which goes directly to the LPs) and in some cases also liquidity mining incentives on top (e.g. Sushiswap rewards SUSHI to LPs in many of its pools).

Liquidity Providers

Typically liquidity providers are investors that want to put their digital assets to work in order to achieve additional passive income through fees and other rewards. There are also other reasons like providing liquidity for your own project’s tokens or as a specific strategy (e.g. automated profit-taking).

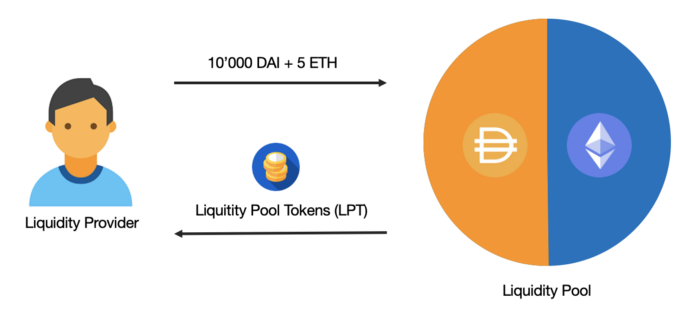

When you provide liquidity, you typically need to provide both assets (in our example ETH & DAI) in equal proportions. This means that if you provide 10000 DAI (equaling $1000) you need to also provide $10000 in ETH (let’s say 5 ETH when 1 ETH = $2000). In some cases (like Thorchain) you can also only provide one asset but the protocol will automatically sell 50% into the second asset to again achieve a 50%:50% split.

Providing liquidity to the ETH/DAI pool.

You then own a certain percentage/share of the pool (let’s say 1%) as a ratio of your liquidity to the total pool liquidity. As proof you get Liquidity Pool Tokens (LPTs) in return, which in some cases can be staked for additional rewards (liquidity mining). Then, when any trade occurs within the pool, the trader pays a transaction fee which is then transferred to you directly into your share of the pool as a reward.

The risk of impermanent loss

One risk liquidity providers have when staking their assets in a liquidity pool is impermanent loss (which could perhaps be called divergence loss). This occurs when the price of your deposited assets changes compared to when you deposited them and to each other (one asset being volatile compared to the other). The bigger the change, the higher the impermanent loss. This loss is temporary as long as you stay in the pool (therefore impermanent) and only manifests itself once you withdraw your funds from the pool (becoming permanent).

Whenever the price of one asset in the liquidity pool changes (like in our example ETH rises) in the market, arbitrage traders or bots come in and add DAI to the pool and remove ETH from it to sell it in the market for profit until the ratio reflects the current market price.

So, let’s say the price of 1 ETH rises from $2’000 to $2’500. Before the price rise and the arbitrage occurs our pool was worth $20’000 but after it, due to the arbitrage the value of your total holdings is now $22’360, consisting of 3.7 ETH and 11’180 as your ETH was sold for DAI to regain a 50%:50% split. If you would have just HODL-ed (HODL, as an acronym for “hold on for dear life,” has become a mantra among crypto enthusiasts denoting a long-term approach to cryptocurrency investing) your funds outside a liquidity pool, you would own 5 ETH worth $12’500 and still $10’000 in DAI and therefore $22’500 in total. So on paper, you lost $140 which amounts to about 0.6% of impermanent loss. In all of this, your share of the liquidity pool stays the same.

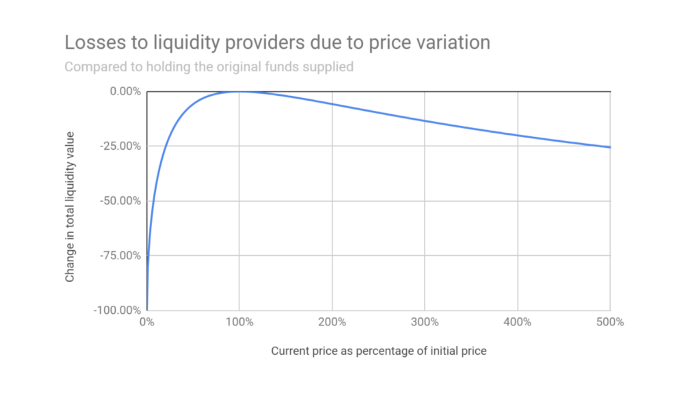

If your ETH appreciated 100% in value instead of “only” 25%, your impermanent loss would equal 6% instead of 0.6%. To calculate a few examples on your own, you can use an online tool such as this one: [Impermanent Loss Calculator]

Alternatively, here are some basic pre-calculated examples:

1.25x price change = 0.6% loss

1.50x price change = 2.0% loss

1.75x price change = 3.8% loss

2x price change = 5.7% loss

3x price change = 13.4% loss

4x price change = 20.0% loss

5x price change = 25.5% loss

As you can also see in the below diagram, the impermanent loss increases with the size of the divergence between the initial price and the current price. Please be aware that it does not matter if the asset price diverges upwards (price rise) or downwards (price loss).

Source: Finematics

What does this mean for me?

What we left out in the above examples are the trading fees that we have gained during our time as a liquidity provider and potential additional rewards based on a liquidity mining incentive program. If the impermanent loss you suffered is mediocre, there is a high chance that you still outperformed any HODL strategy. As you can also see, the longer you are in a liquidity pool, the higher your rewards will be, making it a long-term strategy.

Especially in strong bull markets, when asset prices rise by several hundred percent, being in a liquidity pool can make you REKT (REKT is internet slang for “wrecked,” and often refers to someone who has experienced a heavy financial loss due to a wrong trade or investment). but tendentially the risk of impermanent loss is overstated based on examples in specific market conditions for specific digital assets.

In some cases, a viable strategy can even be to seek impermanent loss. Assuming you believe in the slowdown of a bull market and want to take profits, you can enter a pool with a stablecoin (e.g. USDC) and the asset you want to take profits in (e.g. RUNE). When RUNE climbs in price, the pool will automatically sell it for USDC and therefore take profits for you.

How to mitigate impermanent loss

You can mitigate your risk of suffering impermanent loss by choosing liquidity pools that are either stable (in stable coin pools the impermanent loss is typically 0 if the coins hold their peg) or by choosing a pool where you are equally bullish on both assets (they rise in price in tandem again nullifying your temporary losses).

As mentioned above some decentralised exchanges like Bancor and THORChain offer insurance against impermanent loss (Bancor, Thorchain) compensating your potential losses and some offer slightly different algorithmic models that allow for single-token exposure (also Bancor and Dodo’s PMM model).

Conclusion

We advise you to familiarise yourself with the concept of impermanent loss (without demonising it) and to do a few test calculations before you enter any liquidity pool taking into account the rewards that you may generate over time. Please also always think in advance about the meta-strategy that you are following and the overall crypto market conditions.

Disclaimer

The information included in this article is accurate as of the date of this article.

None of the information contained within this article constitutes, or should be relied on as financial or investment advice or a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale or any other investment-related activity with respect to any cryptocurrencies, the $XDEFI token or any other transaction.

For the avoidance of doubt, this article is not advising you on what to do with your money or cryptocurrencies, it is instead solely summarising and demonstrating some of the opportunities provided by the $XDEFI utility token.

Before deciding whether to purchase any cryptocurrencies, carry out any staking or farming activities or provide liquidity to any liquidity pools, please carry out your own detailed research and due diligence and ensure that you are fully aware of all the risks involved with cryptocurrencies, staking and/or farming cryptocurrencies and with liquidity pools including the concept of impermanent loss.

Please note that we, the XDEFI Wallet team, are not able to provide any financial or investment advice or any kind of potentially price-sensitive information. XDEFI Wallet makes no representations, warranties, or assurances as to the accuracy, currency or completeness of any content contained in this article or any sites linked to or from this article.